lincoln ne sales tax 2020

Quarter cent sales tax allows for six additional construction projects to be completed in 2020. Lincoln 175 725 0725 2-285 28000 Linwood 10 65 065 201-287 28245 Loomis 10 65 065 149-291 29085 Louisville 15 70 07 107-293 29260 Loup City 20 75 075 90-294 29470 Lyons 15 70 07 108-298 29855 Madison 15 70 07 113-299 30240 Malcolm 10 65 065 150-302 30345.

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

The Nebraska sales tax rate is currently 55.

. This is the total of state county and city sales tax rates. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15. There are a total of 334 local tax jurisdictions across the state collecting an average local tax of 0825.

The Nebraska state sales and use tax rate is 55 055. This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax. There is no applicable county tax or special tax.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. The state sales tax rate in Nebraska is 55 but you can customize this table as needed. 2 2020 at 729 PM PDT.

In Nebraska wine vendors are responsible for paying a state excise tax of 095 per gallon plus Federal excise taxes for all wine sold. What is the sales tax rate in Lincoln Nebraska. For tax rates in other cities see Nebraska sales taxes by city and county.

Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton. Did South Dakota v. 31 rows The state sales tax rate in Nebraska is 5500.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. 1 2020 Deshler will collect a new 1 sales and use tax while Unadilla will collect a new 15. 1 the Village of Orchard will start a 15 local sales and use tax.

Nebraskas general sales tax of 55 also applies to the purchase of wine. Ad Get Nebraska Tax Rate By Zip. Nebraska has recent rate changes Thu Jul 01 2021.

Changes in Local Sales and Use Tax Rates Effective January 1 2021. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top of the state tax. The County sales tax rate is 0.

The Lincoln sales tax rate is 175. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. You can print a 725 sales tax table here.

800-742-7474 NE and IA. With local taxes the total sales tax rate is between 5500 and 8000. It has been nearly a year since the quarter-cent sales tax took effect here in Lincoln and as construction season wraps up were.

There are no changes to local sales and use tax rates that are effective January 1 2022. There are no changes to local sales and use tax rates that are effective July 1 2022. The minimum combined 2022 sales tax rate for Lincoln Nebraska is 725.

Select the Nebraska city from the list of popular cities below to. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. 025 lower than the maximum sales tax in NE.

Nebraska Department of Revenue. Free Unlimited Searches Try Now. These changes are on the Nebraska Department of Revenues.

NOVEMBER 18 2020 LINCOLN NEB Tax Commissioner Tony Fulton announced that effective January 1 2021 the local sales and use tax rates for Gordon Greeley and Juniata will each increase from 1 to 15. Average Sales Tax With Local. The Nebraska state sales and use tax rate is 55 055.

Over 14 135gallon. KOLN - This is the first year the city has had an extra 13 million to spend. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

Lincoln Ne Gov City Of Lincoln And Lancaster County Coronavirus Covid 19 Business Resources

Nebraska Ended Fiscal Year With More Revenue Than Expected

Vehicle And Boat Registration Renewal Nebraska Dmv

Nebraska State Tax Things To Know Credit Karma Tax

2020 Nebraska Property Tax Issues Agricultural Economics

General Fund Receipts Nebraska Department Of Revenue

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Make A Water And Wastewater Payment City Of Lincoln Ne

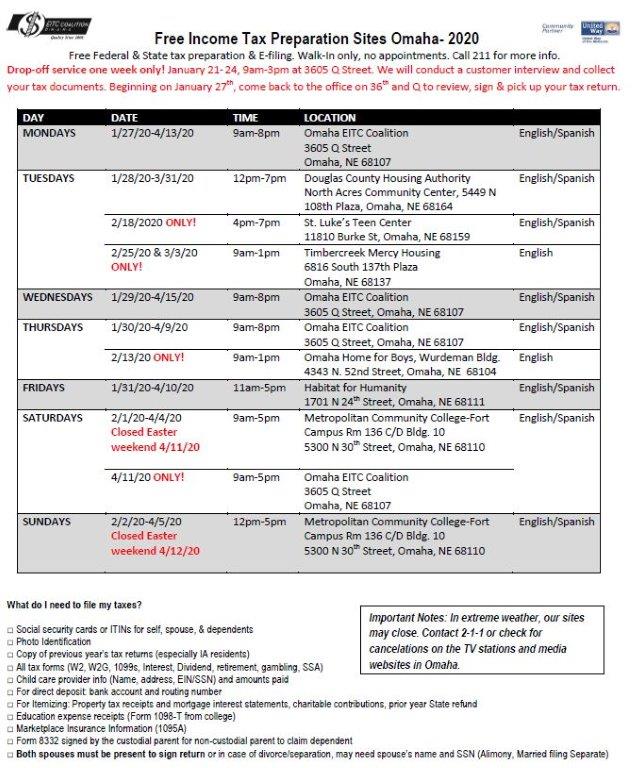

Free Tax Preparation Sites In Omaha Nebraska Department Of Revenue

Refundable Income Tax Credit For Property Taxes Paid To Schools Nebraska Farm Bureau